Update

The charitable sector expressed strong concerns following the release of the 2023 proposed changes with respect to the tax treatment of charitable donations. In response to some of these concerns, the 2024 federal budget proposes to allow taxpayers subject to Alternative Minimum Tax (AMT) to claim 80% of the charitable donation tax credit when calculating the AMT, instead of the previously proposed limit of 50%. However, the 2024 federal budget provides no relief on the inclusion of 30% of capital gains on donations of publicly traded shares in the AMT calculation, instead of such donations being free of capital gains.

Securities can include publicly listed shares, mutual funds, bonds, and flow-through shares.

You can give now, or as part of your estate and will planning.

Why should I donate securities?

By donating publicly traded securities, you:

Reduce Tax*

In most cases, you can avoid paying capital gains tax by donating the securities directly.

Get a Receipt*

Receive a charitable tax receipt for your donation.

Impact Care

Help support patient care and research at our hospital.

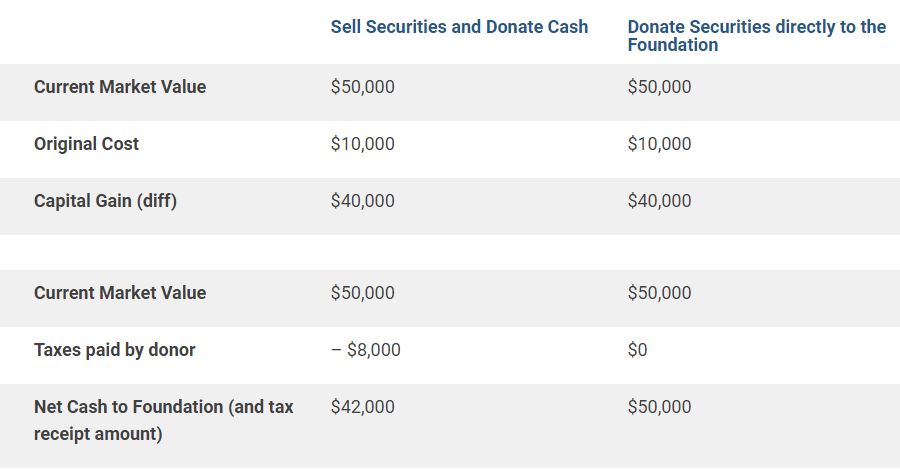

Check out the chart below to see the benefit of transferring a gift of securities:

Sell Securities and Donate Cash

Donate Securities directly to the Foundation

Current Market Value

$50,000

$50,000

Original Cost

$10,000

$10,000

Capital Gain (diff)

$40,000

$40,000

Current Market Value

$50,000

$50,000

Taxes paid by donor

– $8,000

$0

Net Cash to Foundation (and tax receipt amount)

$42,000

$50,000

How do I donate securities with a broker?

1. Talk to your Financial Advisor

Consult your financial advisor to decide which investments will make the most financial and philanthropic impact.

2. Complete and submit the transfer form

Once you or your broker have completed the transfer form and you’ve signed it, it is ready to be submitted to your Broker for processing. This can take several weeks so plan ahead!

3. Contact Us

Send a copy of the signed and completed transfer form to donatingstocks@toh.ca and we will track the progress of the donation and inform our broker.

How do I donate securities if I have a Direct Investing account?

1. Talk to your Financial Advisors

Consult your financial advisors to decide which investments will make the most financial and philanthropic impact. If you use a “direct investing” account, please access their online resources to evaluate their donation process.

2. Complete and submit banking forms

Each financial institution will have their own charitable securities donation form. Please find this form, fill out & sign the form and submit via the financial institution’s instructions for processing (this could include online portal, faxing, or mailing.)

3. Complete and submit TOHF Form

Send a copy of the signed and completed TOHF transfer form to donatingstocks@toh.ca and we will track the progress of the donation and inform our broker.

Did you know?

Most donations of securities take between 3-5 business days. In some cases, due to the nature of the donated security, it can take up to four weeks. Please keep this in mind when you are considering your support.

Can I give securities as part of Estate Planning?

The benefit of donating publicly traded stocks and mutual funds through your will further reduces the tax impact on your estate. A donor can indicate in their will that the gift they are making to The Ottawa Hospital should be made via securities.

Securities FAQ

Canadian Securities: CUID #RTRA Account #210750001

US Securities: DTC #: 901 Agent #80901 DTC account #: 298307 For further credit to account: 210750002

Please work with your broker or financial planner to fill out the TOHF SECURITIES TRANSFER FORM

No. You can also donate without a broker via your financial institution/online platforms. However, a broker can normally help expedite the process as they will work with the back office to ensure your donation is processed properly in a timely manner.

Yes. The same form is used for all forms of securities. TOHF SECURITIES TRANSFER FORM

A: No. If you sell your securities and donate the payout, you will likely be required to pay capital gains tax on the entire capital gain.

If your reported income is more than $173,000/year, transferring those same securities directly to the hospital instead typically means you will have to pay capital gain tax on only 30% of the capital gain. The 2024 federal budget proposes to allow taxpayers subject to AMT to claim 80% of the charitable tax receipt on your taxes. This also holds true if your executor sells off investments to fulfil any charitable gifts in your will.

However, if you donate these same securities and your reported income is less than $173,000/year then typically this means the donation is tax-free. This also holds true if your executor sells off investments to fulfil any charitable gifts in your will.

A: The value of the receipt will be determined by the Fair Market Value of the securities on the date the securities are received in the Foundation’s brokerage account, based on the market closing price for the day. If sold prior to the close of day, the Fair Market Value will be the sale value before commissions. In accordance with our Board Policy, securities will be sold as soon as possible.

Please note: With the revised Alternative Minimum Tax (AMT) regime those with reported income greater than $173,000/year, can claim 80% of the charitable donation tax credit when calculating the AMT.

A: The best time to donate is when you’re ready to give. If you are interested in having a tax receipt for a specific tax year, please keep in mind that between September 1 and December 31 is the busiest time of year for donations of securities. We suggest additional time to ensure your donation arrives by the end of the calendar year.

A: The Alternative Minimum Tax (AMT) is a parallel tax calculation that allows fewer deductions, exemptions, and tax credits than under ordinary income tax rules. The taxpayer pays the AMT or regular tax, whichever is the higher.

The following are the proposed changes:

- 30% of capital gains on donated securities will be taxable

- Only 80% of the charitable donation tax credit can be claimed when calculating the AMT

We would encourage you to work with your financial advisors to understand the tax implications of these revisions and how you might be impacted.

For more information about donating securities to The Ottawa Hospital, please contact us at donatingstocks@toh.ca or by calling Natalee Snell at 613-795-3081.

Contact Us

For more information on giving through your estate or will, contact us at foundation@toh.ca or call 613-296-9671.